How to Master Your Finances: Practical Tips to Help Your Business Thrive

Read Time: 5 mins

- Learn key financial strategies from our financial expert Dr. Okoye to help your business grow and thrive.

- Get practical tips on using simple financial tools like income statements and balance sheets to track progress and profitability.

- Explore how taking control of your finances leads to smarter decisions for long-term success.

Are you in control of your business finances, or are they controlling you? As an entrepreneur, you’re likely balancing a million things at once, so when it comes to managing the numbers, it’s easy to feel overwhelmed. Yet, mastering financial management is crucial to growing your business, maintaining profitability, and securing long-term success.

Eyiyemi Olivia Rogbinyin, Cohort 3 alumna from Nigeria, began her AWEC journey while running a tailoring business during the pandemic. This experience not only sharpened her understanding of financial management but also sparked her transition into drama and acting. Today, Olivia proudly embraces her new identity as an actor and compère.

In Africa, women are leading a dynamic entrepreneurial surge: the ability to manage finances to drive economic growth and innovation. Despite the vibrancy of African markets, women entrepreneurs often face financial barriers that hinder their ability to grow their businesses

Research from the African Development Bank’s Affirmative Finance Action for Women in Africa (AFAWA) reveal that women in Africa are consistently better credit risks for microfinance compared to men. They demonstrate greater trustworthiness and higher repayment rates, highlighting their reliability not only in managing loans but also in effectively handling business finances.

Women entrepreneurs can build on this strength by maintaining robust financial records and proactively managing cash flow. This will ensure they are always prepared to meet their obligations and seize growth opportunities.

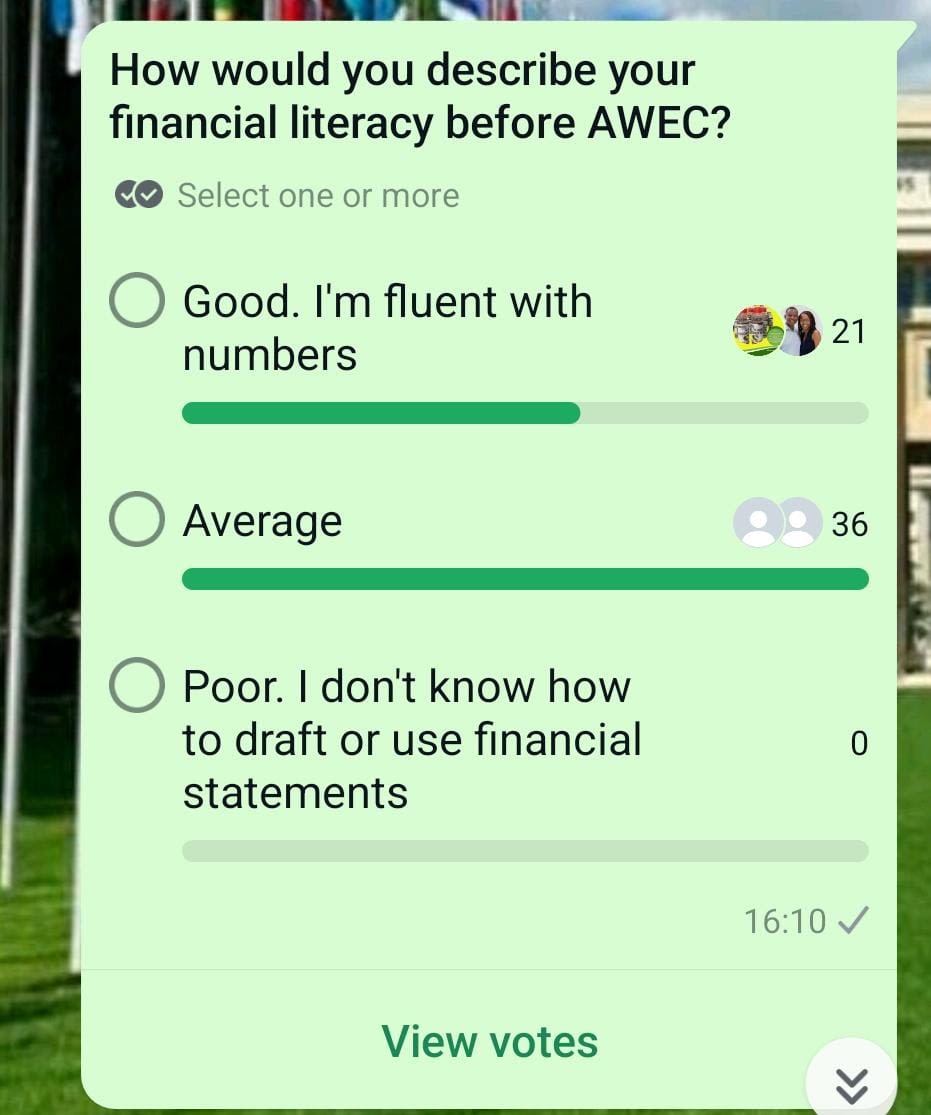

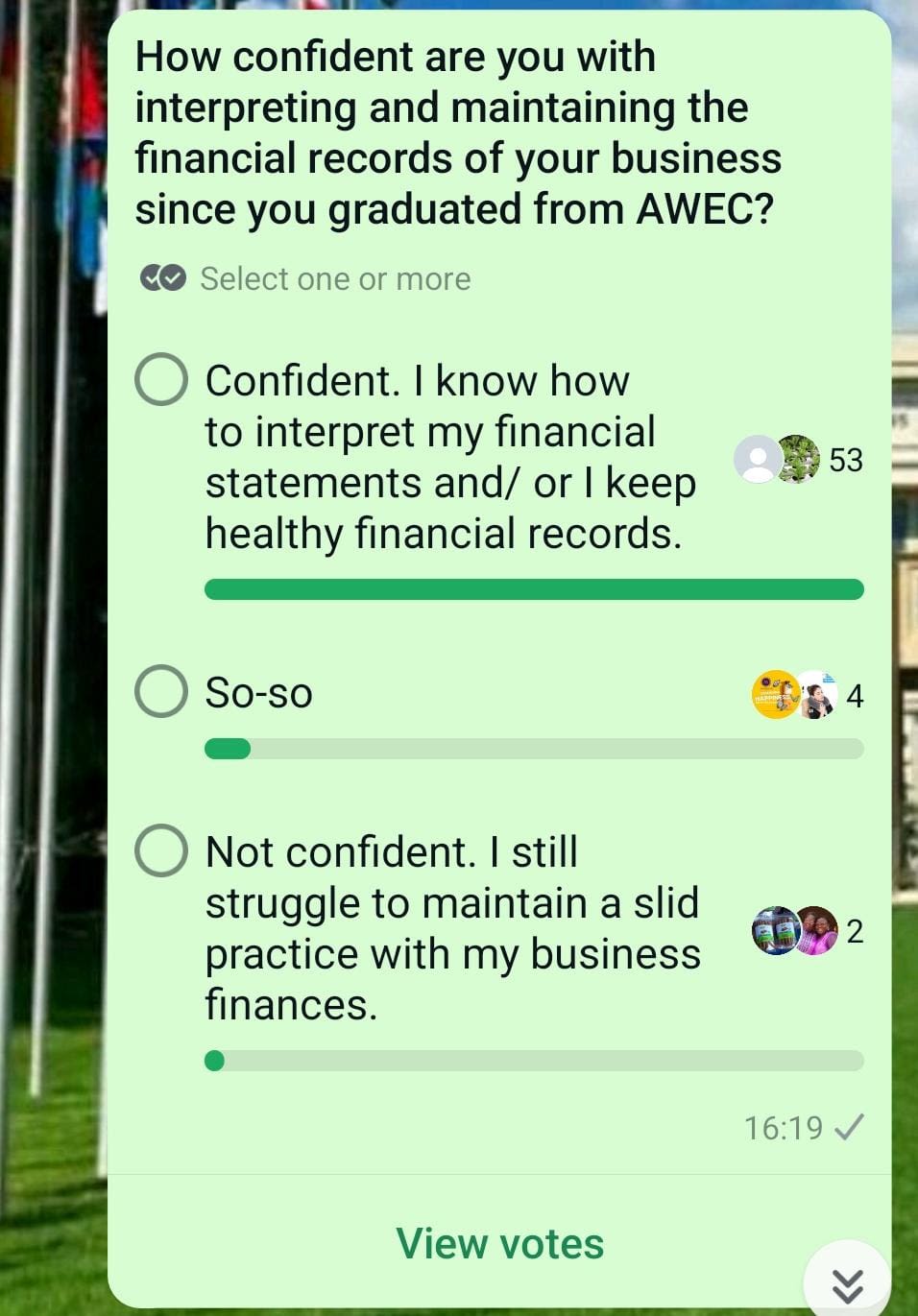

A recent poll conducted among AWEC alumnae revealed that 80% reported significant improvements in financial literacy and confidence since joining the program. When asked about their financial skills prior to AWEC, responses varied from "average" to "good". Impressively, 96% of the respondents now feel confident in interpreting and managing their financial records, underscoring the program's positive impact on their journey to financial health.

The Live Session and assignment on finance stood out for Olivia. She remarked, “It was the most mind-blowing class for me at AWEC.”

She had been relying on handwritten ledgers since 2014. “I engaged a tax consultant and registered with the state tax board, after understanding that my ignorance is not an excuse to avoid my tax obligation.”

“I engaged a tax consultant and registered with the state tax board, after understanding that my ignorance is not an excuse to avoid my tax obligation.”

- Eyiyemi Olivia Rogbinyin

Hear From the Expert

Dr. Francis Okoye - Accounting Professor at Lagos Business School

During the October Live Session, financial expert Dr. Francis Okoye, Accounting Professor at Lagos Business School, led an engaging discussion on how entrepreneurs can better manage their finances to sustain growth and profitability. He emphasized that "while managing the numbers can feel overwhelming, using the right systems, tools, and habits helps business owners to take control of their financial future confidently. " He shared valuable insights into the essential financial records every business should maintain, whether they’re a seasoned entrepreneur or just starting out.

Financial Records Every Business Should Maintain

Income Statements

Your income statement is like a health check for your business. It shows you how much money you’re making (revenue) and how much you’re spending (expenses). By keeping a clear record of your income and expenses, you’ll be able to see whether your business is profitable, which areas need trimming, and where you might invest more.

Additionally, as you prepare your financial statements, it is important to note the stages of the accounting cycle:

- Stage 1: Source Documents (e.g. receipts)

- Stage 2: Journal (the chronological order of transactions)

- Stage 3: Ledger (the book of accounts i.e. debits and credits)

- Stage 4: Trial Balance (identification of any errors or discrepancies)

- Stage 5: Adjustment (resolving discrepancies)

- Stage 6: Closing Account and Stock Valuation

- Stage 7: Preparation of Final Account

Tip: Set up a monthly routine to update this record. You can use simple tools like Excel or affordable accounting software like QuickBooks, Sage, Wave or Xero.

Balance Sheets

Your balance sheet gives you a snapshot of your business’s financial position at any given time. It lists your assets (what your business owns), your liabilities (what your business owes), and your equity (your ownership in the business). A well-maintained balance sheet helps you track your business’s value and spot trends in how your financial situation changes over time.

Tip: Once a month or quarterly, review your balance sheet. Make sure all your assets and liabilities are recorded accurately. This document is especially helpful when applying for loans or bringing in new investors.

Cash Flow Statements

Many businesses struggle not because they’re unprofitable but because they run out of cash. Always remember, cash is queen! Your cash flow statement helps you track the flow of cash in and out of your business. It shows whether you’re bringing in enough cash to cover your bills and day-to-day operations.

Tip: Pay attention to this document regularly, perhaps even weekly if your business handles a lot of transactions. By doing so, you’ll avoid the unpleasant surprise of realizing you don’t have enough cash on hand to pay expenses, even if your sales are strong.

Payroll Records

If you have employees, keeping detailed payroll records is essential. These records should include each employee’s salary, tax withholdings, bonuses, and benefits. Organized payroll records ensure you’re compliant with legal requirements and avoid costly penalties.

Tip: Use payroll software like work pay or Zoho to automate calculations and tax deductions.

Tax Records

Filing taxes is one of the most stressful parts of owning a business, but if you keep your tax records in order, it becomes much easier. This includes keeping copies of filed tax returns, documents showing income received, and records of deductions, credits, and expenses claimed.

Tip: Create a folder, digital or physical specifically for tax-related documents. Organize them by year and keep them safe for at least five years in case of an audit. Regularly update this folder as you receive tax documents.

Self-Help Corner: How to Organize Your Financial Records

Start by establishing a consistent system that works for you. You don’t need to be a financial expert to get this right. Use what’s manageable, whether that’s a spreadsheet, dedicated accounting software, or hiring a bookkeeper for a few hours each month.

Also, set a regular schedule for reviewing your financial records. Weekly or monthly check-ins are ideal for staying on top of things without letting tasks pile up. This routine will help you make more informed decisions and monitor the financial health of your business as it grows.

Olivia's Transformative Experience in Financial Management at AWEC

Olivia developed a disciplined approach to finances. She explained, “When I receive payment, I first pay my tithe, then split the remainder between investments and expenses.” This systematic method has become crucial for her long-term business growth.

“Embracing digital tools like Wave and Zoho Finance became a walk in the park,” she said, appreciating how these platforms streamlined her record-keeping. She noted, “They’re easier to use and less time-consuming, allowing me to categorize expenses effectively”.

Additionally, Olivia implemented a clear separation between her personal and business finances. She says, “This critical separation of my finances enhanced my clarity and fostered better financial discipline,” ensuring she could track her business performance without mixing it with her personal expenses.

Start Today

If you’re feeling overwhelmed and unsure where to start on your financial journey, begin by assessing your current financial situation. Track your income and expenses. Identify areas for improvement. Explore digital tools that can simplify your record-keeping and enhance your financial understanding. Remember, every great journey begins with a single step. Don’t let uncertainty hold you back—empower yourself with knowledge and take control of your business finances today

Are you ready to elevate your business to new heights? The NEW and IMPROVED AWEC Entrepreneur Essentials 2.0 course is now LIVE! Plug in to take your business to the next level!